Originally trained as a neuroscientist, Preet Banerjee now excels within the world of finance. Best known as a financial panelist on CBC’s The National and as a contributor to The Morning Show on Global, Banerjee inspires others to become financially empowered through his world-class expertise and unique ability to take the complexity out of money matters. He speaks on behavioural finance, economics, and personal finance.

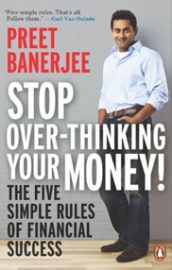

Banerjee is currently a partner and director with Wealthscope Portfolio Analytics and a consultant to the wealth management industry, specializing on the commercial application of behavioural economics. He is also the founder of MoneyGaps, a hybrid-advisor financial technology startup; the host of the podcast, Mostly Money; the author of three books; and a creator with over 120,000 subscribers to his “Money School” YouTube channel.

Prior to this, Banerjee was a financial advisor and worked in institutional investment sales and product development. He is a Fellow of the Canadian Securities Institute and holds both the Derivatives Market Specialist certification and Financial Management Advisor designation.

In 2009, Banerjee won the inaugural Ultimate W Network Expert Challenge, a reality show competition that led to him becoming the host of Million Dollar Neighbourhood on The Oprah Winfrey Network. Since then, he’s been named one of Canada’s Top 10 Financial Visionaries by Advisor.ca and is a past first-place prize winner in the Portfolio Management Association of Canada’s Excellence in Investment Journalism Awards.

Banerjee earned a doctorate of business administration from the Henley Business School in the United Kingdom and holds a Bachelor of Science in neuroscience and a Master of Science in business and management research. He is currently the chair of the Foundation for the Advancement of Investor Rights Canada and was previously a governor of the University of Toronto.