The economic disruption caused by the COVID-19 pandemic has driven our collective anxiety to record highs. Unemployment is up, the stock market is down, and the future feels more uncertain than ever before. But there is actually more within your control than you might think.

This week, we hosted a panel of personal finance experts who answered questions on how to get your finances back on track as part of our Virtual Speaker Series. Moderated by James Cunningham, emcee extraordinaire as well as the president of Funny Money Inc., a financial literacy program designed for senior high school, college, and university students, we were joined by behavioural finance expert Preet Banerjee; CTV’s The Social’s money expert, Melissa Leong; and financial journalist Bruce Sellery.

Each panelist shared insight into the state of today’s economy, how to build healthy finance habits, and what to prioritize today to build a healthy financial future.

Instinct vs. Healthy Financial Habits

While it may seem like the world is in economic chaos at the moment, Melissa was quick to remind us that history and past economic recesses have shown us that we do recover. And, that these downturns can be used as an opportunity to re-evaluate our relationship with our finances and create new strategies to better prepare ourselves for the short- and long-term.

It’s the long-term planning that is the most difficult for us, Preet added. As a behavioural finance expert, Preet draws on psychology to explain some of the financial habits we have. Humans are hard-wired to think in the short term, he said. Our core instinct is to survive, specifically, to survive another day. It’s this instinct that can often warp our thinking and drive many of our habits.

Sellery provided us with a five-step action plan to help us determine our goals and put a lens to the long-term.

- Lay the foundation (resources available to you).

- Determine what you want (buy a house, maintain relationships, retirement, etc.).

- Develop the plan.

- Take action.

- Stay engaged (build the habits now to make you successful later).

What can give us comfort in our long-term planning is remembering that our financial plan is a living, breathing thing. It needs to be flexible because life happens. This flexibility affords our plan to grow with us and our changing priorities and life circumstances.

In times of crisis, Preet said, it’s important to also create short term plans that take into account any short-term changes we’re experiencing. For example, many of us are seeing a loss of income right now. Adding a short-term plan to take into account those losses and use it as a tool eliminate costs, list any new resources, etc., can help mitigate anxiety and give us a sense of control in the situation.

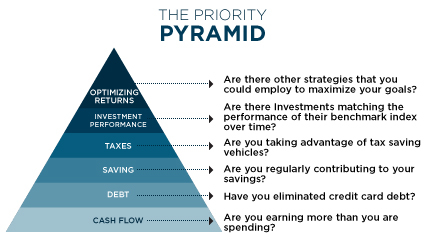

The Financial Priority Pyramid

During this virtual presentation, several attendees had question about investing and whether or not they should be taking the time to make new investments now when the stock market is low.

Bruce said when in crisis, many people can get overwhelmed with the financial choices in front of them. To help streamline their thinking and decision making he shared his financial priority pyramid, which lays out the best way to approach your money and take control of your finances.

- At the base level is cash flow. First determine if you are earning more than you’re spending.

- Debt elimination. Are you carrying credit card debt? Put your money towards paying this off first.

- Savings. Are you able to regularly contribute to a savings plan?

- Tax saving Are you taking advantage of tax-saving vehicles, like TFSAs or RRSPs?

- Once these first four levels of the pyramid are taken care of, you can turn to investments and see if there are investments that are matching their benchmark performance over time.

- Lastly, at the top of the pyramid you can look at optimizing returns and building new strategies to maximize your goals.

If you aren’t currently in the investment game, now is not the time to jump all in, our experts said. Instead focus on this pyramid to find where you fall in your financial planning and focus on doing those things impeccably.

Long-Term Planning

If COVID-19 has taught us anything, it’s that things can change in a matter of days. The most important step we can add to our long-term financial plan is a dedicated emergency fund. It shouldn’t be tied to credit or an RRSP, but instead be a separate savings account, Melissa said.

We tend to spend differently depending on the source of our money, Preet said. For example, if our fridge breaks down and we turn to our RRSP as our “emergency fund” to help us buy a new one, we will see a stockpile of money for our future selves. It’s harder to comprehend what we will need financially in the future, so if we see $200,000 sitting there, we will be more likely to pull more money and buy a more expensive fridge. If we are using our actual emergency fund though, we tend to spend more conservatively because we know it’s for emergencies. This will be even more true now as we have all now experienced a global pandemic.

To be safe, our emergency fund should hold enough money to cover our living expenses for a certain time period. This time period changes depending on your circumstances, Melissa said. As both Melissa and her husband are self-employed, their emergency fund covers one year of basic living expenses. But for others, that can be a daunting time frame and an unnecessary one. She recommends saving six months of basic living expenses if you’re able to. It all starts with creating that habit today of putting aside an amount of money that you’re comfortable with every month.

Our panel ended the session with quick and simple reminders to put us on the right track to financial planning. First, create your vision of the future you want, put together a long-term plan that will help get you there, and start acting on it today. While we can’t always control what happens to us, we can control how we respond to it. Don’t take a “wait and see” attitude towards it, instead start doing something small everyday that puts you closer to the future you want.

A financial panelist on CBC’s The National, behavioural finance expert Preet Banerjee inspires others to become financially empowered through his world-class expertise

Melissa Leong is currently the resident money expert on CTV’s The Social — Canada’s leading daytime talk show — and one of Canada’s best-loved authorities on personal finance.

A regular contributor to CTV’s Cityline and top media outlets, business journalist Bruce Sellery helps people get a handle on their money so they can live the life they want.

James Cunningham has proven that he’s among the most skilled corporate emcees in the world. His personalized performances and attention to detail guarantee laughter and delight.

Speakers’ Spotlight has been offering virtual presentations since 2009. We work with several speakers who are experienced in delivering virtual presentations on a variety of topics pertinent to today’s changing environment. Contact us for more information.