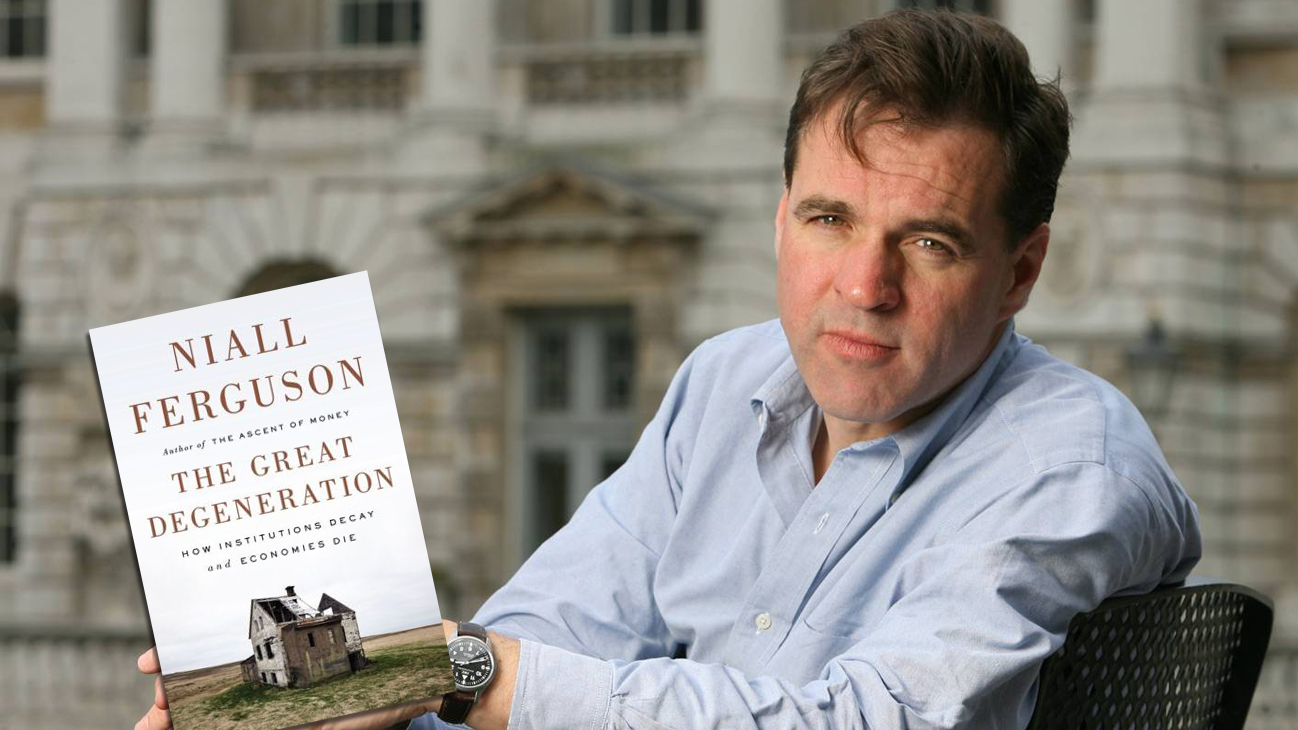

Internationally renowned historian Niall Ferguson’s work impacts industry, finance, government, and academia. Named by Time magazine as one of the “100 Most Influential People in the World,” Ferguson recently released his newest book, The Great Degeneration: How Institutions Decay and Economics Die. To arrest the breakdown of our civilization, Ferguson warns, will take heroic leadership and radical reform. We are pleased to run an exclusive excerpt from the book here:

The Great Degeneration: How Institutions Decay And Economies Die

The voguish explanation for the Western slowdown is ‘deleveraging’: the painful process of debt reduction (or balance sheet repair). Certainly, there are few precedents for the scale of debt in the West today. This is only the second time in American history that combined public and private debt has exceeded 250 per cent of GDP. In a survey of fifty countries, the McKinsey Global Institute identifies forty-five episodes of deleveraging since 1930. In only eight was the initial debt/GDP ratio above 250 per cent, as it is today not only in the US but also in all the major English-speaking countries (including Australia and Canada), all the major continental European countries (including Germany), plus Japan and South Korea.The deleveraging argument is that households and banks are struggling to reduce their debts, having gambled foolishly on ever rising property prices. But as they have sought to spend less and save more, aggregate demand has slumped. To prevent this process from generating a lethal debt deflation, governments and central banks have stepped in with fiscal and monetary stimulus unparalleled in time of peace. Public sector deficits have helped to mitigate the contraction, but they risk transforming a crisis of excess private debt into a crisis of excess public debt. In the same way, the expansion of central bank balance sheets (the monetary base) prevented a cascade of bank failures, but now appears to have diminishing returns in terms of reflation and growth.

Yet more is going on here than just deleveraging. Consider this: the US economy created 2.6 million jobs in the three years beginning in June 2009. In the same period, 3.1 million workers signed up for disability benefits. The percentage of working-age Americans collecting disability insurance rose from below 3 per cent in 1990 to 6 per cent.Unemployment is being concealed – and rendered permanent – in ways all too familiar to Europeans. Able-bodied people claim to be disabled and never work again. And they also stay put. Traditionally around 3 per cent of the US population moves to a new state each year, usually in pursuit of work. That rate has halved since the financial crisis began in 2007. Social mobility has also declined. And, unlike the Great Depression of the 1930s, our ‘Slight Depression’ is doing little to reduce the yawning inequality in income distribution that has developed over the past three decades. The income share of the top one per cent of households rose from 9 per cent in 1970 to 24 per cent in 2007. It declined by less than four percentage points in the subsequent three years of crisis.

You cannot blame all this on deleveraging. In the United States, the wider debate is about globalization, technological change, education and fiscal policy. Conservatives tend to emphasize the first and second as inexorable drivers of change, destroying low-skilled jobs by ‘offshoring’ or automating them. Liberals prefer to see widening inequality as the result of insufficient investment in public education, combined with Republican reductions in taxation that have favoured the wealthy.But there is good reason to think that there are other forces at work – forces that tend to get overlooked in the tiresomely parochial slanging match that passes for political debate in the United States today.

The crisis of public finance is not uniquely American. Japan, Greece, Italy, Ireland and Portugal are also members of the club of countries with public debts in excess of 100 per cent of GDP. India had an even larger cyclically adjusted deficit than the United States in 2010, while Japan faced a bigger challenge to stabilize its debt/GDP ratio at a sustainable level.Nor are the twin problems of slow growth and widening inequality confined to the United States. Throughout the English-speaking world, the income share of the top ‘1 per cent’ of households has risen since around 1980. The same thing has happened, albeit to a lesser extent, in some European states, notably Finland, Norway and Portugal, as well as in many emerging markets, including China.Already in 2010 there were at least 800,000 dollar millionaires in China and sixty-five billionaires. Of the global ‘1 per cent’ in 2010, 1.6 million were Chinese, approaching 4 per cent of the total.Yet other countries, including Europe’s most successful economy, Germany, have not become more unequal, while some less developed countries, notably Argentina, have become less equal without becoming more global.

By definition, globalization has affected all countries to some degree. So, too, has the revolution in information technology. Yet the outcomes in terms of growth and distribution vary hugely. To explain these differences, a narrowly economic approach is not sufficient. Take the case of excessive debt or leverage. Any highly indebted economy confronts a narrow range of options. There are essentially three:

1. raising the rate of growth above the rate of interest thanks to technological innovation and (perhaps) a judicious use of monetary stimulus;

2. defaulting on a large proportion of the public debt and going into bankruptcy to escape the private debt; and

3. wiping out of debts via currency depreciation and inflation.

But nothing in mainstream economic theory can predict which of these three – or which combination – a particular country will select. Why did post-1918 Germany go down the road of hyperinflation? Why did post-1929 America go down the road of private default and bankruptcy? Why not the other way round? At the time of writing, it seems less and less likely that any major developed economy will be able to inflate away its liabilities as happened in many cases in the 1920s and 1950s. But why not? Milton Friedman’s famous dictum that inflation is ‘always and everywhere a monetary phenomenon’ leaves unanswered the questions of who creates the excess money and why they do it. In practice, inflation is primarily a political phenomenon. Its likelihood is a function of factors like the content of elite education; competition (or the lack of it) in an economy; the character of the legal system; levels of violence; and the political decision-making process itself. Only by historical methods can we explain why, over the past thirty years, so many countries created forms of debt that, by design, cannot be inflated away; and why, as a result, the next generation will be saddled for life with liabilities incurred by their parents and grandparents.