Blockchain, metaverse, cryptocurrency, NFTs — these are no longer the buzzwords of the future. Web3 is here and changing business as we know it.

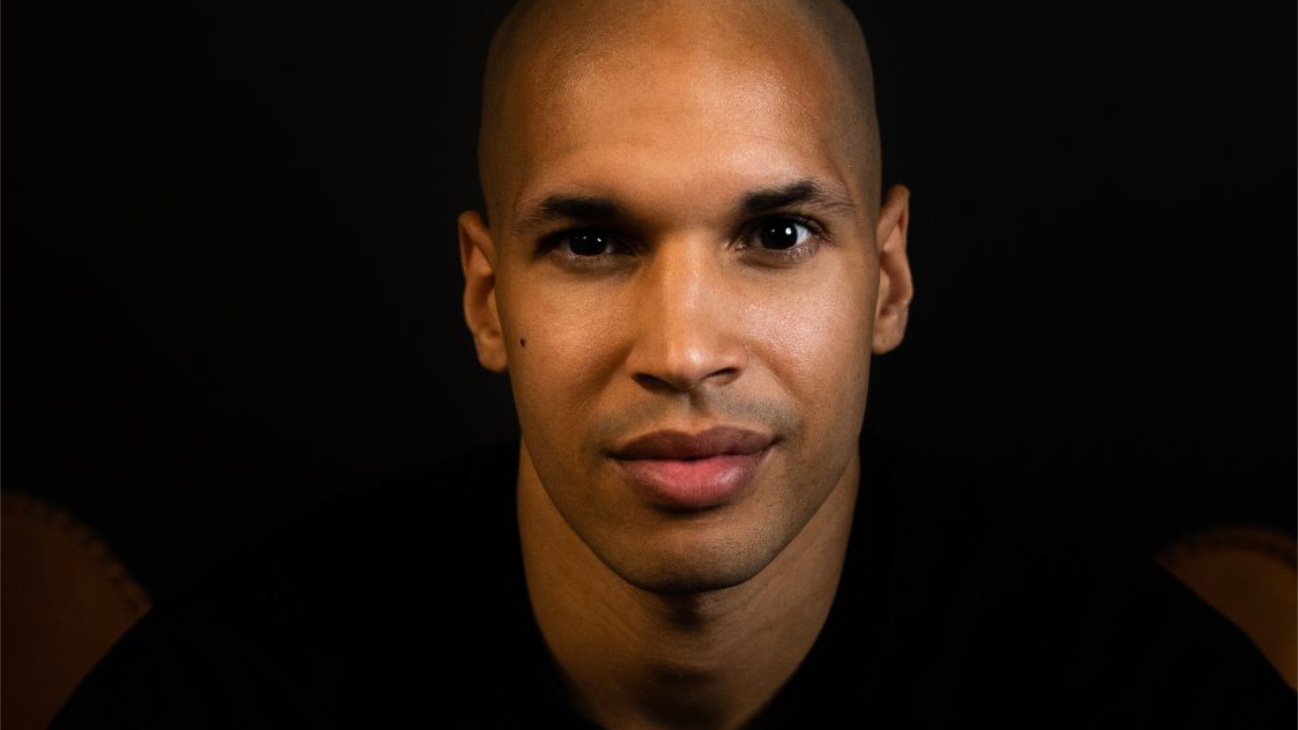

Marc Lafleur, a new speaker on our roster, takes audiences on a deep dive into Web3, exploring how its evolving and shaping the future of work. He shares case studies on how brands are strategically using it to build new revenue streams and enhance their marketing initiatives.

Diving into Web3 can be quite daunting, especially as there are so many different components. Marc put together an amazing introductory guide that gives a great overview of some of the many different pillars within Web3 to help businesses begin their journey.

This is by no means an exhaustive list, Marc writes, but it covers a lot of the big buzzwords we’re hearing right now. Below is a condensed version of Marc’s guide. Read the whole piece here.

1. Blockchains and Distributed Ledgers

Blockchains and distributed ledgers are the technology powering Web3, similar to how the internet enabled Web2.

From a non-technical standpoint, blockchains are databases or lists of data (ledgers) that can be stored on multiple devices rather than a centralized or single device/server. The decentralization of data actually makes it more secure because all devices would have to agree before any changes are made in the database or ledger. In our current centralized system, one owner, whether it be an individual or business, can make unilateral decisions to alter the data.

Marc writes that the creation of the blockchain is similar to what happened when the internet was created. The internet is not the websites we browse or the apps we use, it is the underlying technology that allowed for the connection of networks. This is what fuels many of the tools businesses and individuals use today.

It’s important to note, Marc writes, that bitcoin or crypto are not blockchains. “That’s like saying email or apps are the internet.” Instead, the internet was the underlying technology that allowed for the creation of email and websites. This is the same for blockchain as the advancement of this technology brought bitcoin to life.

2. Bitcoin and Cryptocurrency (These are Not the Same)

First, Marc says, it’s important to note that Bitcoin and cryptocurrency are not the same thing. Bitcoin was created as an authentic and extreme display of what blockchain technology can offer from a decentralized, autonomous, and security standpoint. After more people started adopting it, they found holes and improved upon them, which lead to crypto..

Bitcoin was developed with the single purpose of creating a new currency through the form of a digital token. Tokens can be stored, managed, tracked, sent, and owned transparently on the blockchain without interference from third parties.

What came next changed the game, Marc says. Smart Contracts improve the use of tokens on the blockchain. Instead of using digital tokens simply as a currency that can be sent and received, Smart Contracts allow users to apply code to these token, which enables them to do cool things, Marc writes.

This is similar to the development of HTML and Java Script. The first webpages created on the Internet allowed users to interact with them by reading text on a screen — that’s it. You couldn’t click on anything, you couldn’t add videos, you couldn’t sign in, you could just read, Marc writes.

The introduction of Java Script allowed users to interact with webpages as we do today — being able to click links, post content, send content, etc. So, the same way Java Script and HTML allowed us to do more with webpages, Smart Contracts allow us to do more with blockchain and tokens, Marc writes.

Whereas bitcoin was created to be a new currency that has no owner and is not managed by any organization, Marc continues, Smart Contract tokens are businesses using blockchain and tokens to create new products and business models. This is the difference between Bitcoin and crypto. Bitcoin is in its own world, doing its own thing, while crypto are businesses using Smart Contracts to create, improve, or deploy new products, services, and technologies.

3. Wallets: Your Passport into Web3

One of the most powerful arguments for using bitcoin and crypto is that blockchain technology allows you to have full control over your assets rather than having a third party, like a bank, hold it for you, Marc says.

“Ask people if they own their money, most will say yes,” Marc continues, “when you ask them where they keep their money, they’ll say the banks. The key thing to understand here is that if you have your money in the bank, technically you don’t own it.”

With crypto, there is no bank. The tokens are stored on the blockchain and Web3 wallets allow users to have an easy, user-friendly way to interact with them. Another way to understand this is using the analogy of websites. Websites are a collection of code, but most people don’t want to view content as code, so developers created the front-end of a website, which looks nice, clean, and is easy to use vs. the back-end which is full of code.

This is what Web3 wallets do for the blockchain. They are the front-end so you can easily interact with what’s going on in the blockchain. And, more importantly, you own this wallet, giving you complete control over the assets held within it and you don’t need to go through a bank to use them.

4. NFTs: Non-fungible tokens

NFTs stand for non-fungible tokens, which is a fancy way of saying something that is unique, Marc says. It can’t be replicated. In non-digital terms, this is like saying you had two of the exact same Pokémon cards, he continues, however one of them is considered first edition and the other is considered second edition. Technically, they are non-fungible because even though they have the same art with the same Pokémon, one of them is labelled as first and the other is labelled as second. They are not the same.

NFTs evolved from Smart Contracts. As we moved from blockchain and distributed ledgers to bitcoin and crypto, and then on to Smart Contracts, we could do “fancy things”. One of the first things people did was attach media files to tokens. When you attach an image to a digital token, you have an NFT. These NFTs can be held in your wallet just like bitcoin and crypto.

Some people may hear NFTs and think about digital pictures of monkeys being sold for $500,000, Marc writes. Right now, most of the hype around NFTs has been focused around profile pictures, collectibles, and community access. But Marc believes NFTs will evolve into a source of digital identification. This is when we’ll stop calling them NFTs and refer to them as digital art, digital passes, digital ID, digital memberships, etc., Marc says.

5. The Metaverse: Or just Virtual Worlds?

Marc says we are a LONG way away from a true Metaverse. Most people describe the metaverse as a virtual world where we can connect with others online and participate in various activities. This does exist, but for something to be called “The Metaverse”, Marc says, it needs to be more than that.

A true metaverse, he continues, would be a digital world that is not owned or controlled by one entity. It connects with all other metaverses and accepts all digital assets no matter who created them. This doesn’t exist yet.

With Facebook changing their name to Meta, this signaled that their new focus is “The Metaverse” but right off the bat, Marc says, the idea of Meta owning their metaverse makes it the opposite of a metaverse. It’s just another virtual reality world where users can interact with each other, products, and services the way Meta wants them to.

Many more virtual or digital worlds will start popping up, but “The Metaverse” will not exist until it’s fully decentralized. Marc recommends the movie Ready Player One, if you want to see a real metaverse in action.

6. DAOs (Decentralized Autonomous Organizations)

There are a LOT of different types of DAOs out there, but very few actually live up to the name. To build a truly decentralized and automated organization, Marc writes, requires some heavy tech lifting.

Most DAOs joining the landscape today are more attune to communities gathered around a shared purpose, such as wanting to buy a sports team together. These social DAOs are basically online communities that share a bank account, ownership, and collectively vote on the operation of that community.

The shared bank account is what keeps people aligned in the DAO — everyone is incentivized to act in its best interest. In addition to this, the DAO usually provides tokens for its community members, which allows everyone to benefit as the DAO increases in value and allows them to vote on how the DAO operates.

Now, you can start to see how all of these components of Web3 are coming together. Marc writes:

“Blockchain was the enabling technology; the subsequent cryptos that were created are allowing these organizations to create, distribute, or track real dollar value; the idea of selling NFTs to access the DAO and then verifying that you own that NFT in your wallet are all just examples of how fast the results of this technology are all being Frankenstein’d together to create completely new use cases and businesses models.”

As a founder, DAOs are what really excite Marc about Web3 as he believes community building is the next frontier of effective sales and marketing strategies. He speaks more about this in his keynote, “Sales in a Digital World: Building a Community Around Your Customers.”

Contact us to learn more about Marc and how he can help your organization begin their journey into Web3. As the founder of three companies, including truLOCAL, he also speaks to leadership, entrepreneurship, talent retention, and more.