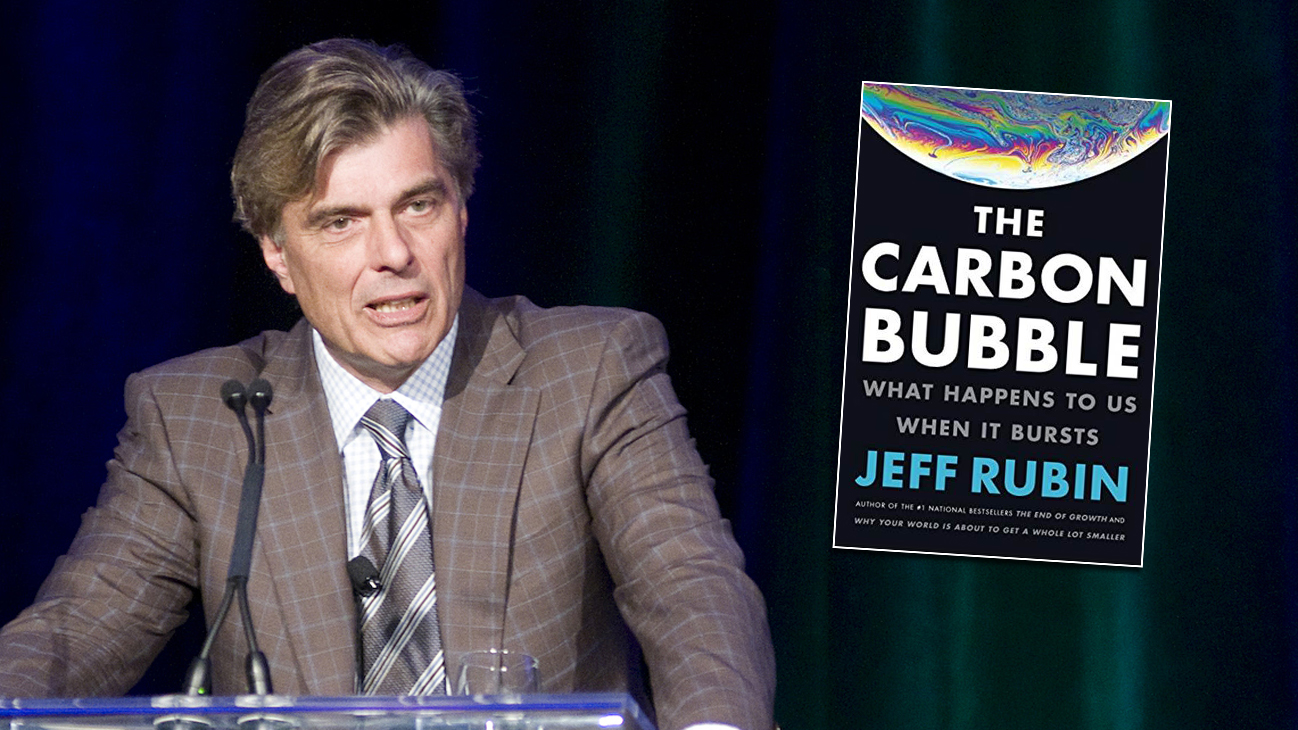

What do sub-prime mortgages, Atlantic-salmon dinners, SUVs, and globalization have in common? They all depend on cheap oil. Jeff Rubin, one of the world’s most prominent experts on the future of “black gold,” explains why the end of cheap supply means the end of easy answers to renewing prosperity—and the end of globalization as we now know it. Rubin was the former Chief Economist at CIBC World Markets (for almost 20 years), is a frequent columnist for The Globe and Mail, and is the bestselling author of Why Your World Is About to Get a Whole Lot Smaller, and The End of Growth. His new book is The Carbon Bubble: What Happens To Us When It Bursts. NOW magazine spoke with Jeff about why it’s time for oil sands producers to pull back:

For almost a decade, Canada has been chasing one man’s dream.

Stephen Harper wanted the nation to become an energy superpower. Now we’re living the fallout.

“Our oil-sands-leveraged economy is at the epicentre of the bursting global carbon bubble,” says Jeff Rubin in his new book, The Carbon Bubble: What Happens To Us When It Bursts.

The former CIBC chief economist lays out how Harper’s master economic plan was rooted in faulty assumptions that the price of oil would keep climbing, the U.S. would keep buying and China’s double-digit growth would keep driving global demand – and that Canada could keep cranking out the world’s dirtiest oil unfettered.

Rubin says it’s time for oil sands producers to face the music and stop pouring billions into new deposits they’ll never be able to burn.

NOW sat down with him last week to pick his brain about bubbles, pipe dreams and growing green – or not growing at all. Here are excerpts from that conversation

On why Harper’s oil-or-nothing mission was bound to fail

“Harper has been a master salesman, and when he first started pitching Canada as an energy superpower, we were ready for that message. We were living in the shadow of the dot-com boom – the U.S. had never been greater, and we had never been more irrelevant. All of a sudden the U.S. and China need our oil, oil’s over $100 a barrel and we’ve got lots of it. But we didn’t have the pipeline capacity to go from shipping 2 million to 5 million barrels per day.”

On the future of pipelines

“Before you know it, America is producing 10 million barrels a day and they want to start exporting. So Canada’s high-cost oil lost its market. Then it’s a question of getting the oil to a seaport. [Pipelines] lost their economic context. Without expanded production we don’t need new pipelines. TransCanada and Enbridge have shipper agreements for proposed pipelines. But those agreements are based on production growth that is now being cancelled.”

On facing up to a bursting carbon bubble

“What people don’t understand is that this engine of economic growth has lost about 70 per cent of its share value in the last three years. Does that sound like there are going to be billions of dollars available to flow into that sector? All you read about every week are [oil sands projects being] cancelled…. Who’s going to invest in expansion? The real question is how much of the 2 million barrels Alberta is producing today is sustainable. A lot of people producing today are producing at a loss. You can only do that for so long before – boom – the capital gets shut off.”

On making bread, not oil, in the prairies

“Harper may be right: the west may be the engine of economic growth, but it ain’t going to be bitumen. It’s going to be food. The Canadian prairies are a climate-change hot zone. Turn the thermostat up 3° in Peace River, you’re growing corn, but if you turn the ‘stat up 3° in Iowa, Illinois and Kansas, guess what? You’ve got drought. Canada is going to be one of the biggest beneficiaries of climate change. This has not been lost on Monsanto, Dupont, Pioneer – they’re not blind to climate change. For the last couple of years they’ve been doing road shows in farming communities across the prairies telling wheat farmers how to grow corn. We should be spending millions figuring out how we can best manage water resources on the prairies in a world of climate change.”

On Alberta’s political swing left

“In some sense it’s a product of the carbon bubble after an Alberta government [said] we must do whatever we can to accommodate oil sands growth. That dream has turned into a nightmare. But I’m not sure the NDP government has an alternative vision.”

On lessons from the oil sands

“The very triple-digit oil prices that made pulling bitumen out of the ground a commercially viable activity killed economic growth. We’ve had almost a decade of experience with [those] prices. During that time we had the deepest recession in a postwar period and the most anemic recovery. On top of that, we’ve learned that we’re already at 400ppm CO2. [The world’s] got a carbon budget of maybe 1,000 gigatons [before we raise the planet’s temperature more than 2°]. That sounds huge until you realize we’re emitting 35 gigatons a year, so we’ve only got about 25 years.”

On why more people should dump carbon-heavy stocks

“Just what have Suncor, Cenovus, Canadian Natural Resources and Canadian Oil Sands done for your portfolio recently? A lot of people go, ‘Well, Jeff, I don’t own those stocks – I just own TSX index.’ You’re talking about one of the oiliest stock indexes in the world, and they’re the worst-performing. I’m trying to get a financial institution to provide the TSX composite minus the oil sands. I’m going to be doing some stuff with the Toronto 350.org about U of T. I’m an alumnus. My son goes there. It has the largest endowment fund in Canada, about $1.9 billion. We should really jettison these stocks from our portfolio, not so much to save the world, but rather to enhance the return of the endowment fund.”

On becoming a green economist

“We’ve all been schooled in thinking there’s a fundamental trade-off between doing what’s right for the environment and doing what’s right for the economy. The carbon bubble turns that on its head. We’ve got to find new sources of powering the economy. That’s why environmentalists might embrace my message. I don’t come from an NGO background; I come from an investment banking background. I’m just saying when you look at the implications for the economy, the route is clear. You’ve got to reduce carbon per unit of GDP or else we don’t grow.”

Advice for Kathleen Wynne on Energy East: dump it

“It’s a little hypocritical to accept kudos for closing down the coal plants but then be a conduit for a pipeline that is going to facilitate a doubling of oil sands production. What difference does it make if the carbon is coming from the Nanticoke coal plants or from Fort Mac? One thing Wynne could do and should do is not spend $15 billion refurbishing the Darlington reactor when for probably half a billion we could boost the transmissions system and import the excess hydro power from Quebec.”

On how the oil sands bust will play in the election

“If I’m Stephen Harper, I’m not feeling warm and fuzzy because I’d assume most of those people who voted NDP were voting conservative federally. On the other hand, when I hear Justin Trudeau say carbon pricing is best left to the provinces, and that’s his idea of leadership, maybe Harper doesn’t have that much to worry about.”