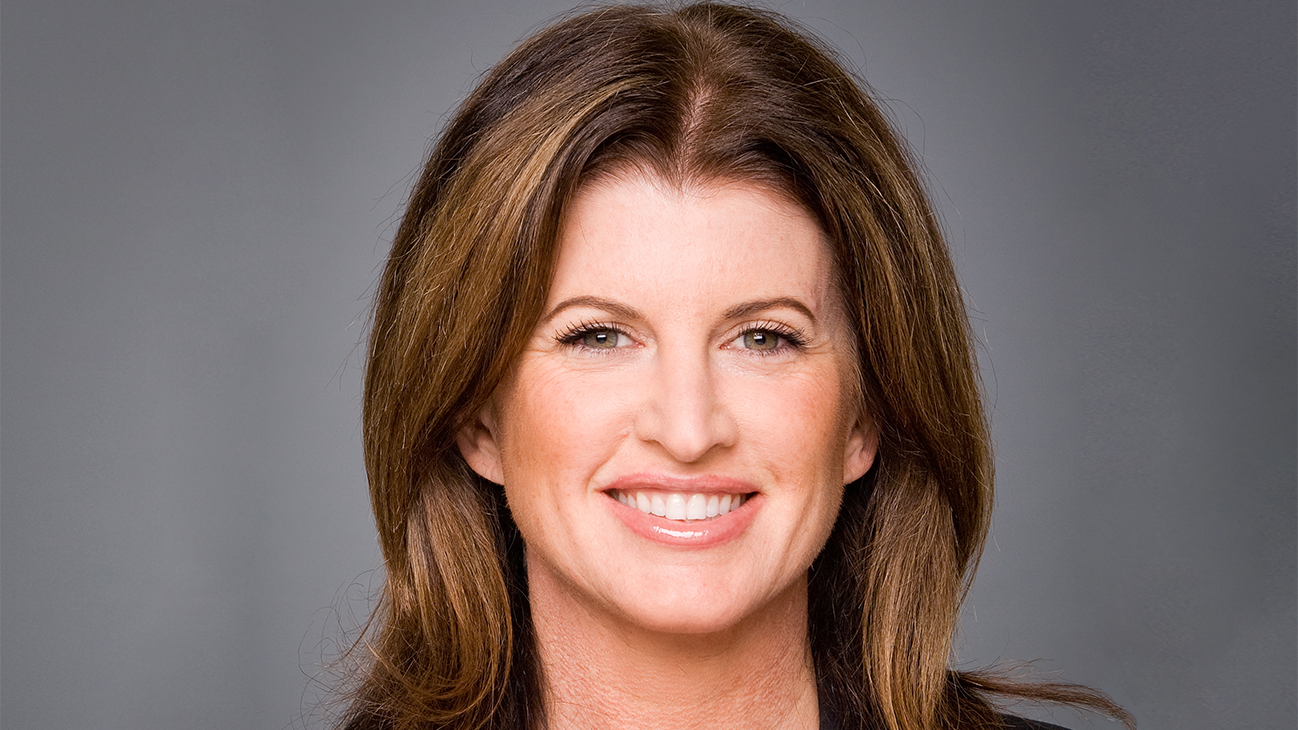

Rona Ambrose knows politics. She successfully rose to lead the largest political party in Canada. After her tenure as leader, the Conservative Party had the highest membership in its history and is viewed as competitive, more modern, and inclusive. Rona is proud to be the first leader of that party to march in a gay pride parade. Pundits say “Rona made it look effortless” — accomplishing all of this while also being named the most civil parliamentarian. Ambrose is also on the Canadian team negotiating NAFTA, and she recently had a story in the Financial Post on some of the realities we’re facing.

The bad news is uncertainty seems like the only certainty. The good news is you can hear it directly from Rona in these excerpts:

On NAFTA, like most things, President Trump hasn’t been subtle. He’s made statements about NAFTA’s shortcomings, the possibility of killing the deal, and the positive future for the U.S. if it’s terminated. It isn’t tough to draw a straight line between his statements and the Americans’ take-it-or-leave-it negotiating approach. The U.S. negotiating team is clearly conveying the president’s willingness to push things to the brink and, just maybe, tip NAFTA over the edge. In fact, the very economic uncertainty created by so much brinksmanship is likely strategic and deliberate.

…

So, “what’s the worst that could happen?” For Canada, it’s the fate of NAFTA lingering in limbo while U.S. agencies force the hands of Canadian companies through tactical regulatory and trade decisions — as happened with Bombardier and is also happening in the softwood lumber industry. But whatever the worst outcome is, the bad news for Canada is that every NAFTA scenario ends with continued economic uncertainty for us, and the U.S. coming out on top. Here are some of the most likely:

The Twitter Withdrawal Scenario

President Trump posts that dreaded tweet saying the U.S. is pulling out of NAFTA. (And now that Twitter offers twice the space, he might also share some thoughts on the deal’s shortcomings and Canada and Mexico’s negotiating approach.) Markets and currencies react dramatically and negatively in all three countries — but at least trade lawyers get to put a deposit on that Maserati they’ve been eyeing, knowing the six-month withdrawal period will be a bonanza for those who can bill for expert tactical advice.

Still, most analysts agree that Congress will have its say on any U.S. withdrawal. Many elements of NAFTA are implemented in law, something the president cannot unilaterally change. So the questions will be: What can he change? Can Congress stop him? And will they?

What can he change? Can Congress stop him? And will they?

A number of key U.S. legislators have clearly stated they do not want to see NAFTA unwound. But this is Congress: If they want to fight the president, they’ll need bi-partisan support to reach 60 votes in the U.S. Senate to get past him. And that means a lot of unpredictable drama.

And just picture that scene: Congress fighting the president to keep a trade deal that we know is widely unpopular among American voters. In that fight, my money’s on the president and the anti-trade populists. On the other hand, if Congress dithers, eventually initial currency and market shocks will level off and something like the indefinite post-Brexit purgatory could befall the North American economy. As businesses plan and invest for a weaker economic platform in North America, they will seek to secure access to the largest market and favour the U.S. over Canada.

The Zombie Standoff Scenario

Maybe the president never posts that tweet, but instead continues his hard-line negotiating approach. Canada and Mexico have said they will stay at the table indefinitely to ensure they are not blamed for the collapse of NAFTA. That means an endless, pointless zombie negotiation that never dies, with officials bouncing between capitals, politely disagreeing.

The good news: NAFTA stays in force and we are spared the short-term economic shock of a cancellation. The bad news: Uncertainty lingers and the never-ending fear of NAFTA ending weighs on investment decisions, making Canada and Mexico more risky places to invest than the U.S. So America wins again.

The Poisoned Chalice Scenario

What if we actually conclude a modern NAFTA agreement? Again, we have to consider Congressional dynamics. Do we think that Canada can agree to NAFTA dairy provisions acceptable to the Wisconsin constituents of Speaker Paul Ryan and Senator Ron Johnson? And given the acrimony in Washington, how many Democrats in Congress will endorse a Republican NAFTA plan? Remember that the Trans-Pacific Partnership was negotiated by a Democrat with the support of many traditionally Republican business constituencies — and ended up demonized by both presidential candidates in the recent U.S. election. That suggests ratifying a new NAFTA in this environment will prove exceptionally difficult politically.

And that’s just Washington. Mexico will be getting a new president next year who might reject a deal struck by his or her predecessor and demand new negotiations. Try imagining how Trump, with an eye on his own country’s elections in the U.S. later in 2018 and soon again in 2020, would react to a demand like that from Mexico. So at this point, given the state of North American politics, even a deal doesn’t guarantee an end to all this uncertainty.

Read the full story here.