Even at seven o’clock in the morning, Digital Technology and Marketing Guru Tod Maffin’s upbeat and enlightening presentations on digital technology and marketing bring audiences to their feet. Recognized as a thought leader in online business innovation and strategy, he sheds light on trends and technological advancements, specializing in campaigns for specific sectors, from human resources to social media to real estate to education.

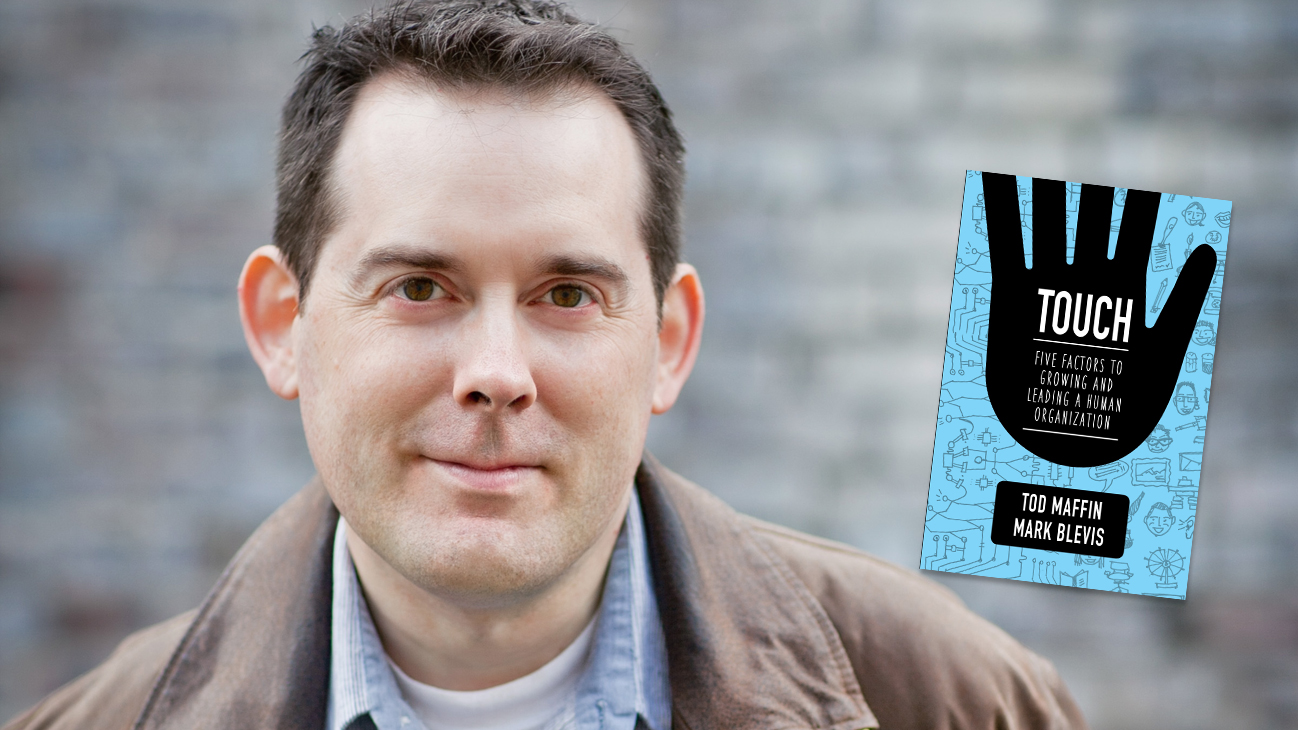

This Thursday, October 4, Tod publishes his new book (with co-author Mark Blevis) TOUCH: Five Factors to Growing and Leading a Human Organization. In the book, Tod looks at how digital business has fundamentally changed organizations–how, through the use of technology, organizations have lost the critical person-to-person connection that is the engine of commerce, and provides real-world, tested solutions, that can be put to use right away. We’re thrilled to share a sneak peek into the book today:

TECHNOLOGY: Hire Your Technology

Stop thinking about your technology as nothing more than a computer. You should treat your business technology as you would an actual human employee. Have a job description for which a technological solution may apply. Then, conduct regular performance reviews (luckily, your technology won’t ask for a pension).

- Does the technology that serves your organization still do as good a job now as when you first brought it on board?

- Is it taking too many sick days (downtime)?

- Do you have a growth and succession plan in place for when you exceed its capabilities?

In far too many cases, the answer to these questions is either “No” or “I have no idea.”

We’re not talking about a general sense of these items either. Schedule annual performance reviews of your CRM (customer relationship management) system. Invite the people who work closest with it. Ask them to submit reviews of the system’s job performance over the past year. Ask these colleagues of the technology to advise on when it needs to be promoted (more money invested in it) or fired.

This regular performance review (call it a “tech audit” if you’re uncomfortable with the human language) is critical because your business grows, your stakeholders change over time, and your objectives shift. Your business technology should evolve with these changes.

MARKETING: Matching Offers to Human Emotions

Taking facial detection one step further is Russia-based marketing tech company Synqera. Its system, called Simplate, detects emotions in shoppers to offer timely promotions based on shoppers’ real-time feelings.

It uses touch screen tablets placed at retail checkouts. When shoppers stand near the tablet to pay, software scans their facial expression to determine the emotion they’re likely feeling and offers coupons and discounts tied to that feeling. Feeling low? Perhaps this deal might make you feel better! Feeling angry? Perhaps our customer service team can intervene right now for you! Feeling elated? Here’s a coupon for next time to brighten your day even more! These offers aim to target shoppers right when a small boost might help them feel more kinship with the brand.

A side benefit is that the aggregated data of shoppers’ moods can act as a kind of informal focus group, helping retail brands understand what time of day tends to be most stressful for people, what day of the week people seem happiest, and so on.

COMMUNICATIONS: Beware the Julies

The key is to use faces of real people who work for your organization, not just any face.

Tod had to inquire about a specific train ticket the other day on Amtrak, so he went to their web site to try to get some information. There, on the top of the screen, was the image of helpful customer service rep named Julie who claimed she could help.

Julie was, of course, just the brand name for Amtrak’s customer service software response engine. And she wasn’t exactly helpful.

Typing “I need to change the seat of a wheelchair user whose ticket I have purchased” got him unrelated text about how seating is assigned. (Julie even audibly reads out the text.) Tod then typed “But I need to CHANGE the seat,” and Julie, apparently suffering from brief amnesia, simply repeated back exactly what she said before.

Don’t confuse putting a human face on your Frequently Asked Questions list with actually taking steps to humanize your organization.

Julies seem to be a bit of an epidemic lately.

The Twitter account at Canadian credit union Coast Capital Savings is identified by an attractive young customer service rep named, well… guess. “She” responds to customer service comments online in a friendly, human tone.

@Coast_Capital

@Bradley – Hi Bradley, sorry to hear that you are unhappy. Is there anything that we can do to help?

@Coast_Capital

@Bikesandcode – Ooops is right. I’m so sorry to hear that you have had such a frustrating experience.

Good tone, to be sure.

But Julie is not a real person. Julie is just the customer-facing brand of Coast Capital. There is no real Julie. The woman in the photo was an actor hired by the company. Coast Capital’s e-marketing specialist actually does most of the speaking for her, though, presumably — like “Shamu” at Seaworld who never dies — if this real person leaves, the next person in the role will simply put on the cloak of Julie.

The idea was thought up by Coast Capital’s ad agency. As head of marketing Vivian Caporale explains, it was an attempt to align offline branches with the online service channel. “The year prior, we had introduced a new branch design. It was very a open and customer-centric design. Central to that design was the concept of having a greeter and a greeter desk. It was at the forefront of our branch design.”

But when the branding team went back and looked at their web site, there was a mismatch. “That’s how Julie was born. We have greeters in our branches; why don’t we have greeters on our web site?”

One more potential issue: Responsibility for the Julie account at Coast Capital lies with Marketing, not Member Service. An odd choice, considering “Julie” primarily deals with members inquiries and complaints. It’s reminiscent of the days when the IT department held tight reign over a company’s forward-facing web site — technically, yes, it’s an information technology product, but its real value was marketing the organization. While certainly tight integration is necessary between the two teams (after all, Caporale notes, “there’s a certain level of quirkiness and humour that really talks about our brand personality”), the main department holding responsibility for member service should be, well, Member Services.

While some would argue the “Julieization of the web” that this puts a humanizing face on the organization’s support team, members will soon realize that the person they’ve been talking to all along hasn’t been who they thought. It’s a good start, but this particular implementation of humanizing their member service department only goes halfway.

To be fair, Coast Capital’s Julie account does indeed provide stellar service. Most tweets — even angry ones from members — are responded to in a personable tone. And with more than a half million members (making them Canada’s largest credit union by membership) and 50 branches in southwest British Columbia, they’re clearly doing something right. But we’d like to see them use their real people in their dealings with real members.