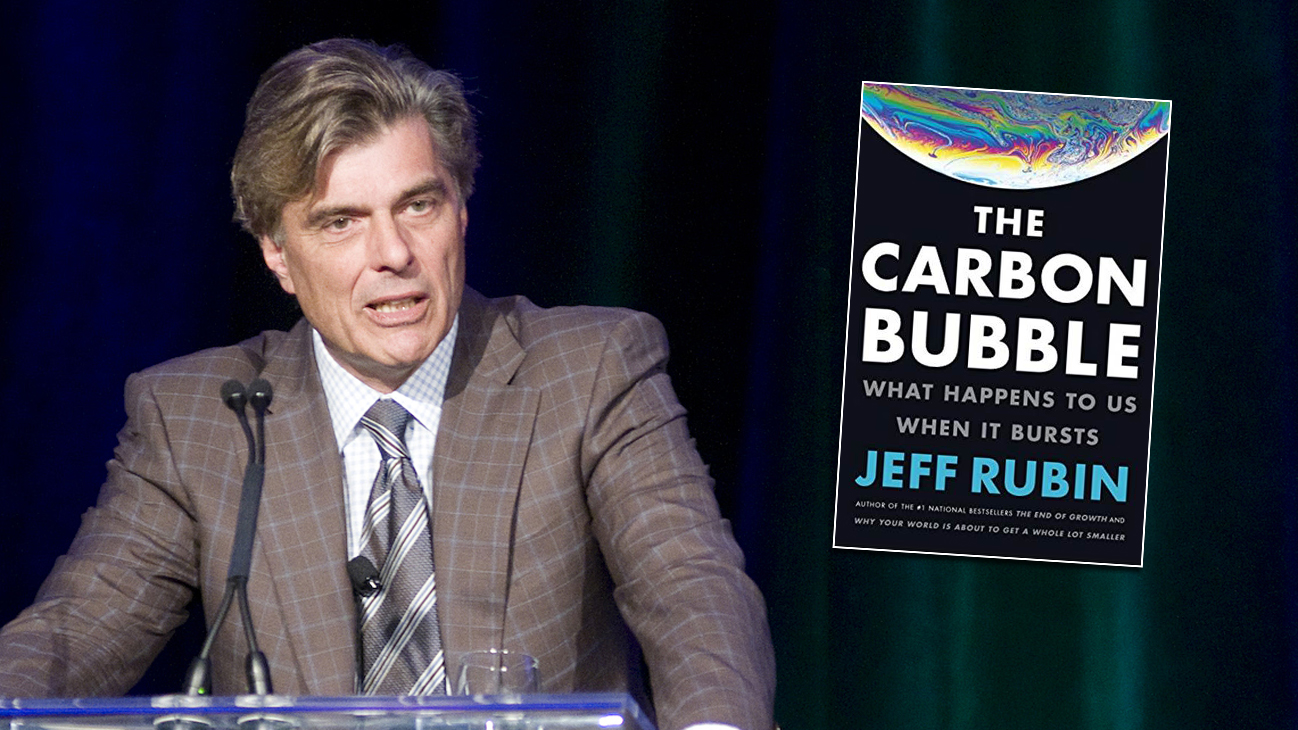

What does the painful collapse of oil prices mean for the future of the Canadian economy? Economist and prognosticator Jeff Rubin writes in his new book The Carbon Bubble: What Happens to Us When it Bursts that the decline is a sneak preview of what’s in store as the world wakes up to the perils of climate change and severely limits carbon emissions. Rubin recently spoke to The Star about how the collapse in oil prices resembles other financial bubbles, what lies ahead for oil stocks, and how Canada can find new opportunity:

Q) What is a carbon bubble?

A) The carbon bubble, the subprime mortgage bubble, and the dotcom bubble are all based on a fundamental premise that turns out to be false. In the case of the dotcom bubble, it was that we could have unending exponential growth in IT sales. In the case of the subprime mortgage bubble, it was that securities funded by mortgages of unemployed people should be as credit worthy as government of Canada treasury bonds.

With the carbon bubble, the implicit assumption here is that we can burn and emit as much carbon as we can afford. That view has become increasingly challenged by the link between what we emit and the climate change we’re seeing.

Q) Has the carbon bubble already burst?

A) For all intents and purposes, the bubble has burst. If you look at the Blackrock’s iShares Oil Sands Index ETF, which is an exchange-traded fund that covers all the TSX-listed oil sands producers, it has lost about 70 per cent of its value since early 2011. Not only has that been a huge negative for investors in energy stocks, it’s also been an albatross around the index. It has brought down TSX returns relative to other indices.

Q) What lies ahead for the oil sands?

A) I think what lies ahead for the oil sands is what’s happened to coal stocks. Three years ago investors in Peabody Energy (the world’s largest private-sector coal company) would go to sleep every night confident that there would never be a global agreement on carbon emissions. Three years later they woke up to a nightmare. Even though there was still no global agreement, China and the U.S. — the two largest coal-consuming countries in the world – both took actions (to curb emissions) that were as devastating to the valuations of coal stocks as an global binding treaty on carbon emissions would be. It’s a small step to go from coal to oil.

Q) What’s in store for Canada as the world moves to limit carbon emissions?

A) I think that one of Harper’s greatest failings is his denial of climate change. It turns the blinkers to what could be great economic opportunity in this country.

Climate change is going to have a profound impact on the Canadian Prairies. When you consider the kind of temperature increases being talked about, two or three degrees, that’s going to transform the agricultural potential of that region. Growing grain is going to be a lot more value-added than producing bitumen.

Q) How does that create new opportunities for Canada?

A) The same climate change that will allow you to grow corn on the Prairies will also make it much more difficult to grow corn in places like Kansas and Iowa. When we had that huge drought in the U.S., which is exactly what climate change models are predicting, we saw corn prices rise by 50 per cent. Climate change is not only going to increase crop yields, it’s going to open the door to growing higher value-added crops. Climate change is likely to push food prices a lot higher than oil prices.

Q) How prepared is Canada for these changes?

A) We’re not really preparing for the opportunities that climate change is going to bring. We have to start thinking about how our economy is going to operate in the next couple of decades as the climate warms. Water management is going to be our biggest issue. I think we also have to start bulking up in terms of the Arctic and build deep water facilities and recognize the opportunity there.